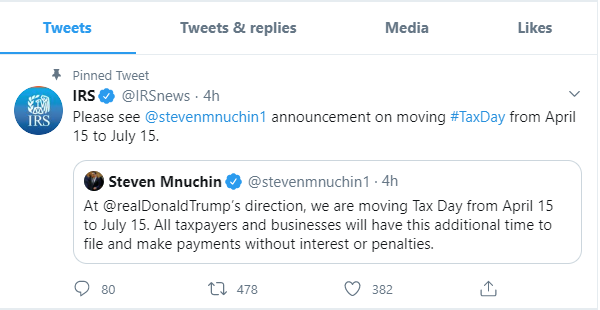

UPDATE 3/20/20 – Secretary Mnuchin announces IRS Income Tax Payments are not due until July 15, 2020.

This morning (3/18) President Trump issued an emergency declaration allowing individuals and non-corporate tax filers to defer paying up to $1 million in Federal Income Tax to July 15, 2020 with no interest or penalty.

The declaration also allows corporate filers to defer paying up to $10 million to July 15, 2020 with no interest or penalty.

All income tax filers must still file their taxes by the April 15, 2020 deadline.

Both the Arizona Department of Revenue (DOR) and the Internal Revenue Service (IRS) offer information and free resources to taxpayers.

The Arizona Department of Revenue has established a helpful resources page for taxpayers called AzTaxes.gov. At the time this post was written Arizona still requires taxes be filed and paid by April 15, 2020. Check the Az DOR website for up to date information.