On July 31st the state legislature sent SB 1102 to the Governor’s desk. She signed it on August 1st.This bill was the long awaited bill allowing the MAG (Maricopa Association of Governments) regional transportation plan tax to continue for another 20 years. Now that the legislature and Governor have agreed on a plan and tax, the voters of Maricopa County will see it on their 2024 ballot where they will decide to approve or reject it.

Do you favor the continuation of a county transaction privilege (sales) tax for regional transportation purposes in Maricopa County? YES ___ NO ____

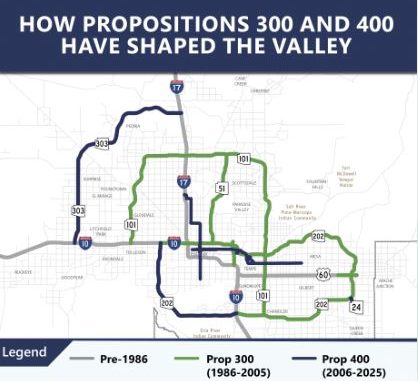

For several decades, the cities, towns and the county of Maricopa have joined to produce a regional transportation plan addressing all forms of transportation. The ability to contract for those transportation projects and to apply for federal and state transportation dollars is often sighted in a positive light since the joint efforts result in large projects (Loop 101, Loop 202, etc.) being planned and paid for on a specific schedule.

To finance these county projects a sales tax must be approved by the voters. The current transportation plan and tax expire in 2025, so it is important an updated plan and tax be approved before 2025.

While there has been a lot of media coverage and water cooler discussions about the Prop 400 extension, the bill signed by the Governor is different than previous measures.

I encourage you to put aside comments and media coverage. Read the bill yourself, read the MAG transportation plan.

Major transportation infrastructure is what makes our modern lives possible.

When you go to the ballot to vote on the transportation plan and extend the collection of the sales tax to 2045, consider the needs of today, but also consider the needs of the future.

Maricopa County is growing because our economy is growing. Does this transportation plan help extend the multimodal efforts of the past 40 years into the next 20 years so that living and working in Maricopa County continues to be personally desirable?