For several years WeSERV Government Affairs has advocated for housing product (availability), both rental and purchase, designed for wage earners with gross yearly incomes between $45,000/year and $95,000/year. That translates to a net income of approximately $40,000 and $80,000/year.

A large portion of wage earners in the Phoenix Metro and Pinal County area earn between $45,000 and $95,000 a year gross income.

To meet the affordability need of wage earners in this group, rents ranging between $885.00 to $1758.00 a month are most affordable based on total housing costs being 25% to 30% of net income.

There are several reasons rents for this wage earner group have gone up. Supply is one reason. Both supply that was sold to owner occupant buyers in 2020, 2021 and 2022 because the government’s policy of tenant’s not paying rent translated into distressed rental property owners who sold while they could; and supply lagging because of material shortages, material costs increases, labor shortages, and supply chain problems.

Today, one very big reason may be government policy – again. Specifically, government housing policy known as Section 8 Housing Choice Vouchers (HCV).

For over a decade, lower end wage earners have seen housing supply disappear when HUD (U.S. Department of Housing and Urban Development) announces their yearly increase in HCV income limits and Fair Market Rents.

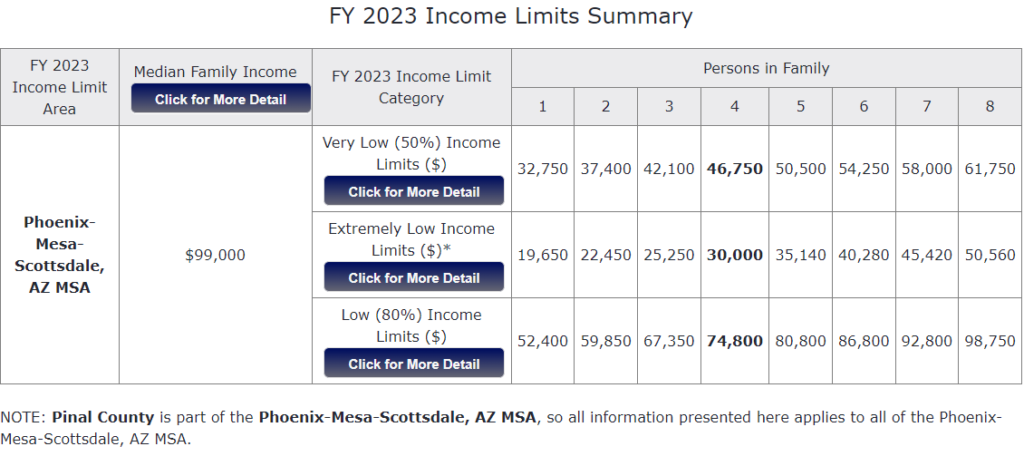

A quick look at HUD’s 2023 Median Very Low and Low Income Limits for Maricopa and Pinal Counties shows that in several cases, wage earners are earning less income than HUD program recipients.

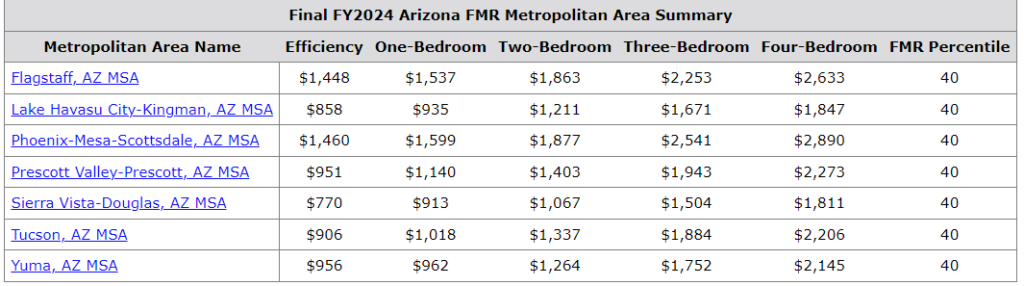

Now look at the HUD 2024 Fair Market Rent amounts for the HCV program:

Wage earners are competing with HUD program recipients and rents are rising to meet the HUD amounts for everyone as rental property owners assume wage earners can pay at least as much as HUD program recipients.

Consider this as well, between 2020 and 2024 HUD Fair Market Rent amounts increased between 51% and 73% depending on the bedroom count. Wage earners were being priced out by government program rental rates.

All this points out…perhaps the intention of HUD Fair Market Rents has been flipped and is now doing harm?

Instead of helping low income people afford a simple and frugal rental, have the HUD rental rates been contributing to the displacement of wage earners?

Market principles still exist. When rental rates rise to more than 30% of wage earner net income and ability to pay, they stop renting. Rental property owners in turn begin to lower rent rates and/or begin to include incentives like additional free rental months, free utilities or waiving of the application fees. All this to reduce the net cost to the tenant and induce choosing to rent the property.

We saw this net cost reduction happen very quickly in the Pinal market over a few weeks in September 2023. And that weakness is still present in some markets. But, if government rental assistance is higher than the actual market, then the government sets an artificially high rental rate.

Perhaps a better solution is to reassess the impact and purpose of government rental housing assistance.

WeSERV has formed a task force to look at government housing programs and the negative impacts on builders, developers, and those who access the programs for their housing needs.

If you are a WeSERV member (REALTOR® or Affiliate) and would like to join the task force to help identify problems and their solutions, please contact WeSERV Government Affairs.

weservgad@weserv.realtor

WeSERV Housing Resources:

WeSERV Housing Report 2023: The Web of Housing Solutions

WeSERV Pinal County & City of Eloy Housing Demand Survey 2024