The Congressional Conference Committee, chaired by Texas Congressman Kevin Brady, released their report/final bill.

The report contains the bill and an explanation/synopsis. The explanation begins on page 510 of the document.

If you or your clients have a pass-through entity, you will want to speak with your CPA or tax attorney soon. Most provisions of this bill take affect for the 2017 tax year. Overall, passive income is treated to a lower tax rate than earned income. It is conceivable that a partnership with one active daily manager and one equity partner would see the daily manager pay more income tax than the passive equity partner.

Deloitte had a created nice quick overview guide. The bill itself is easy to read, so be sure to read the bill along with any analysis you choose. Here are some highlights I noticed:

MID is preserved up to $750,000 for new loans after 12/14/17. Current loans up to $1 million grandfathered in.

Standard deduction: $12,000 single, $24,000 married filing joint return.

Mortgage credit certificates left in final bill. DPA products usually contain these and provide an additional 20% MID on federal taxes.

MID on HELOCs repealed unless proceeds are used to substantially improve the home.

MID on second homes still in place subject to limits.

Up to $10,000 deductible for the aggregate of state and local property taxes, sales taxes or income taxes.

Medical expenses remain deductible.

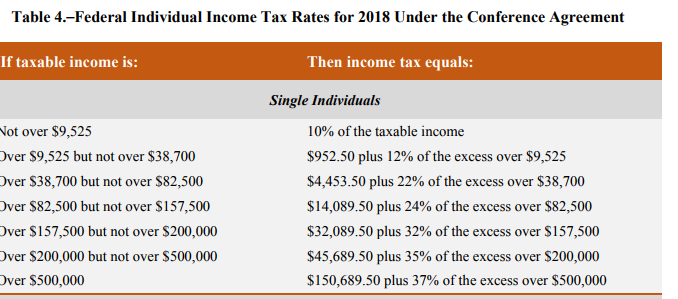

Tax rates change to 7 rates from 10%-37%.

Repeals personal exemptions.

Corporate AMT is repealed.

Personal AMT is retained, but exemption amount increases to $70.3K for single filer and $109.4K for joint. Phased out thresholds increase to $500K and $1 million.

Capital gains 15% with max of 20% for some income brackets. 25% rate on recapture of depreciation (real property).

Child tax credit doubles to $2,000.

Moving expenses are only deductible by active military.

Capital gains rule on principal residence remains as is.

Pass through income:

– 20% of income from business can be deducted subject to threshold amounts.

– Thresholds: taxable income over $157,500 but less than $207,500 for single and income over $315,000 but less than $415,000 joint, deduction will be phased out.

– Above these incomes, no deduction for personal service income, but non-personal service income can get the 20% deduction subject to the W-2 wage cap. Business owners can calculate their max deduction based on 50% of W-2 wages paid or a combination of 25% of W-2 wages paid plus 2.5% of unadjusted basis of all qualified tangible property invested in the business.

– Overall passive income receives more favorable treatment than earned income.Not sure how real estate businesses will be affected by “Qualified Trade or Business” exclusion:

(3) Qualified trade or business. For purposes of this subsection, the term “qualified trade or business” means any trade or business other than— (A) any trade or business involving the performance of services in the fields of health, law, engineering, architecture, accounting, actuarial science, performing arts, consulting, athletics, financial services, brokerage services, or any trade or business where the principal asset of such trade or business is the reputation or skill of 1 or more of its employees, (B) any banking, insurance, financing, leasing, investing, or similar businessDepreciation schedule for real property remains as is

1031 Exchange only real property qualifies for “Like Kind”

Charitable Contribution deduction remains with cash contribution limitation increased to 60% and may be carried over in some cases up to 5 years.

Some refi’s will qualify under the grandfathered terms for MID.

Casualty losses are not deductible unless the loss was part of a Federally declared disaster.

Estate Tax exclusion increased to $10,000,000 per taxpayer. Estate, gift and generation skipping tax 40%.

Time limit to contest an IRS levy is increased from 9 months to 2 years.

Repeal of Obama Care Individual Mandate tax

Increases max current expense threshold to $1 million. Applies to nonresidential property.

Solar and other energy efficient credits for residential property not extended and will be phased out.

Low income housing credit remains for residential rental housing.

Historic rehabilitation tax credit changes made to 60 month and 24 month selections.

ADA expenditure tax credit for small business remains in place.

Retains 50% limitation for food/beverage associated with taxpayer’s trade or business.

Recharacterization of regular, annual IRA contributions (except Roth IRA conversions) permitted. Once IRA converted to Roth IRA, it cannot be changed back.

Unrelated Business Income must be calculated for each activity. Losses may only offset income from that specific activity and can be carried forward.

Repeal of tax credit bonds issued after 2017.

***Several provisions of this bill will sunset in 2025***