Housing Affordability, it’s an ongoing conversation and to be honest I don’t ever remember not hearing about it.

These days people tend to include workforce housing in their considerations, not just low income. For us in Arizona, low inventory is usually sighted as the cause of dramatically increased housing prices whether rental or purchase. With less than a month of inventory on the MLS, the market is indeed under a lack of supply stress. But there are a number of issues currently impacting prices.

While we have .49 months of inventory according to the MLS at the time of this writing (May 2021), that is up from the .36 months of supply in April. While you don’t see a huge number of new houses coming up out of the ground, there are thousands of already entitled lots across Arizona cities. Lots that are now ready to build on.

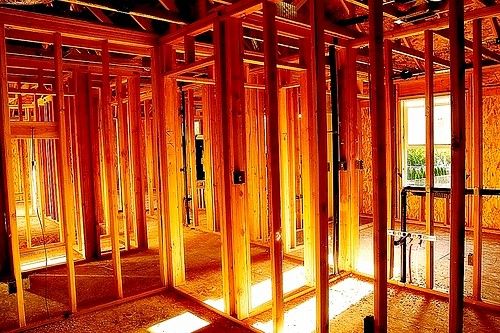

Which brings us to a very big and very real factor in limited new builds: supply and expense of building materials. We have all heard builders in Arizona talk about a shortage of lumber and the price going up as much as 300% in one year. But other products are in short supply as well. Here are some year-over-year material cost increases as of April 2021 according to the National Association of Homebuilders (National Average):

86% Lumber

67% Steel

49% Copper

20% Aluminum

14% Plastics (PVC, moisture barriers, resins in paints/adhesives, etc.)

12% Gypsum products (wallboard)

79% Diesel fuel

7% Truck Transportation

These are just a few of the price increases and they don’t just stand alone. There is a layering of costs as items like energy costs are part of the manufacturing and transport of commodities at each step of the process.

Labor prices are going up as well across all the industries, so increased labor costs and labor shortages are layered in multiple times during the process.

Let’s take lumber as an example. Trees have to be grown and cared for, they have to be harvested, milled and eventually sent to market. Every one of those steps in the process has material costs, labor costs, energy costs and transportation costs, not to mention any government regulation costs.

Add to that the physical lumber shortage partly due to the lapse of the U.S. and Canada lumber agreement and partly due to the Canadian Annual Allowable Cut amount being reduced, and you have upward pressure on pricing. That means we are seeing very little Canadian lumber and an increase in European lumber, which means another increase in costs.

Now add increased tariffs. The Commerce Department reduced lumber tariffs in 2020 from 20% to 9%, but has now recommended an increase to 18.32%.

And then there is capacity. In 2020 capacity dropped dramatically at all points in the process, but particularly in the sawmill capacity in Canada. According to the Madison Report, U.S. sawmill production was at 86%, while Canadian sawmill capacity was at 77%.

Just as I like to look at entitled parcels to see into the future of construction, I like to look at commodities futures as one element in trying to see how pricing will be a few months out.

Here is a glimpse at lumber costs so far in 2021:

- 1/18 $668/1000 board feet

- 3/18 $886/1000 board feet

- 5/6 $1327/1000 board feet

- 5/18 $1327/1000 board feet

- 5/25 $1350/1000 board feet

- 6/1 $1356/1000 board feet

When it came to labor there were and are shortages with Covid shutdowns and limitations on capacity.

Depending on the commodity you choose to look at, there may have been additional issues. The Texas freeze, Japanese earthquake and the Suez Canal blockage are a couple of the events that jump to mind. Each providing an avenue for increased costs and limited production.

According to the Wall Street Journal, mining companies are still leery about increasing mining operations because of fears demand may not stay as strong as they need for as long as they need in order to recoup costs.

So, looking at all these related costs it is easy to see why some builders are offering buyers contract cancellations or including escalation clauses in their purchase contracts. It is also easy to see why new rentals are having dramatic cost increases.

But the limiting factor overall will be the ability for people in the area to afford the rental or purchase price. And that is why some builders have slowed down and others have stopped for now. If they can’t build for a price the market can afford, no matter the home niche, then waiting for the commodities market to stabilize is a reasonable choice.

We are already seeing capacity increases and production increases. International agreements are being discussed and labor is coming back into the market.

It will take time, but costs will come under control and builders will be able to build again for a predictable price.

In the meantime, buyers, tenants and sellers need to attend to the basics.

Sellers: make sure you know how much you need to net in order to move to the next location. And make sure you know where that next location is.

Buyers and tenants: Don’t get caught up in the frenzy. Make sure you keep saving for the down payment, initial deposit or other expenses. Pay down excess debt, and improve your profile for lenders if you are being financed or for landlords if you are a tenant.

If you don’t have a credit score, sign up for Vantage Score. Vantage Score is a tri-bureau credit scoring model that includes payments not usually found on a FICO credit score. Items like rent payments, utility payments and cell phone payments can be added to the Vantage Score.

Buyers, sellers and tenants should make sure they know the difference between their “wants” and their “needs”. Be ready to compromise on the “wants”.

You can see the New Residential Construction information at the U.S. Census Bureau if you would like a nationwide perspective on building permits, construction prices, construction starts and other topics related to new construction.